change in net working capital meaning

Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year. Working capital is a measure of both a companys efficiency and its short-term financial health.

Cash Flow Statement How A Statement Of Cash Flows Works

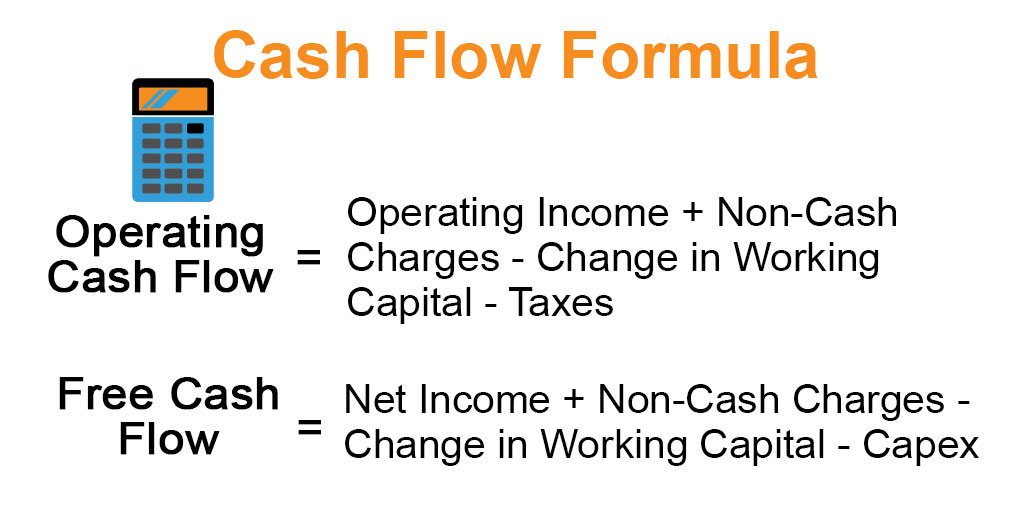

Since the change in working capital is positive you add it back to Free Cash Flow.

. If the change is positive it would mean there is more cash outflow in the form of more current assets. Net working capital is defined as current assets minus current liabilities. So this would mean a.

This means that for a company with positive net working capital NWC will grow as sales grow and be a use of cash. As a business your aim is to reduce an increase in the Net Working Capital. Define Changes in Net Working Capital.

The net working capital figure is more informative when tracked on a trend line since this may show a gradual improvement or decline in the net amount of working capital over an extended period. It means that the company has spent money to purchase those assets. For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042.

How to improve net working capital. They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and. Change in Net Working Capital Formula Example 2.

Define Changes in Net Working Capital. So this increase is basically cash outflow for the company. But if sales fall a scenario I worry about as a lender NWC may or may not shrink and free up cash to meet loan obligations.

Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales. Net working capital is the excess of current assets over current liabilities of a company which is why it is an important indicator of companys financial health. A company can simply improve its profits.

A change in working capital is the difference in the net working capital amount from one accounting period to the next. Positive working capital is when a company has more current assets than current liabilities meaning that the company can fully cover its short-term liabilities as they come due in the next 12 months. Means changes in accounts receivable adjusted for non-cash items plus changes in inventory adjusted for long-term and non-cash items less changes in accounts payable adjusted for royalties and rebates.

Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities. Any change in the Net Working Capital refers to the difference between the Net Working Capital of two executive accounting periods. The change in net working capital is always positive meaning more working capital is required for projects considered in capital budgeting because all projects are either expansion projects or replacement projects which have expansion effects.

Examples of Changes in Working Capital. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. If your working capital ratio reaches 2 it may indicate a company is sitting on assets and not growing efficiently.

So current assets have increased. There are many ways to improve net working capital. If a companys owners invest additional cash in the company the cash will increase the companys current assets with no increase in current liabilities.

Change in Working capital does mean actual change in value year over year ie. Any change in the Net Working Capital refers to the difference between the Net Working Capital of two executive accounting periods. Change in Working Capital.

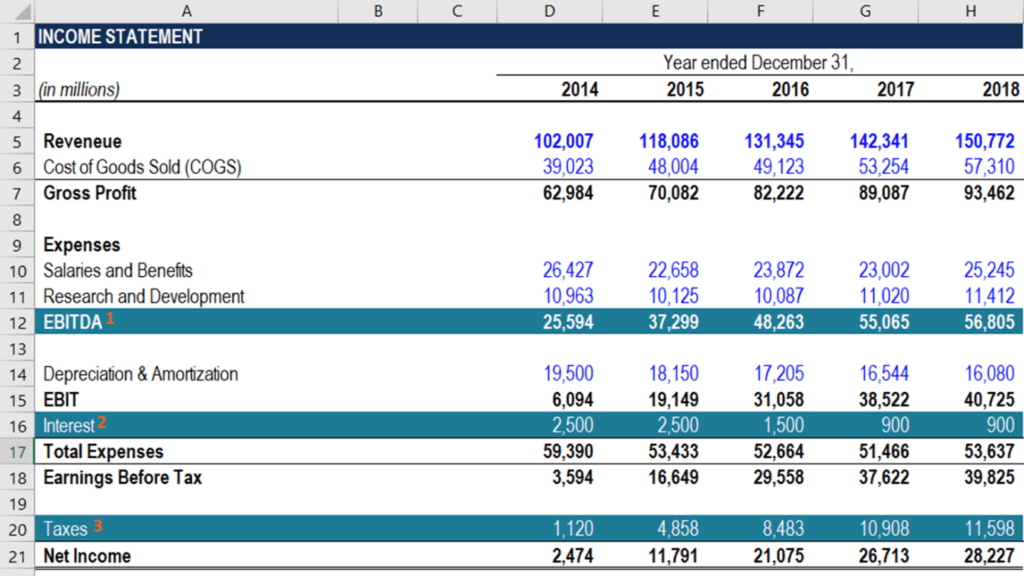

Calculations and Meaning 19. First each component of working capital as a percentage of sales is calculated. This is because an increase in the Net Working Capital would mean additional funds needed to finance the increased current assets.

Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities. Generally a 21 ratio of current assets to current liabilities is considered to be an adequate amount of net working capital. Therefore Microsofts TTM owner earnings come out to be.

18819105991263-13102 19192 34245. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should. This is a negative event for cash flow and may contribute to the Net changes in current assets and current liabilities on the firms cash flow statement to be negative.

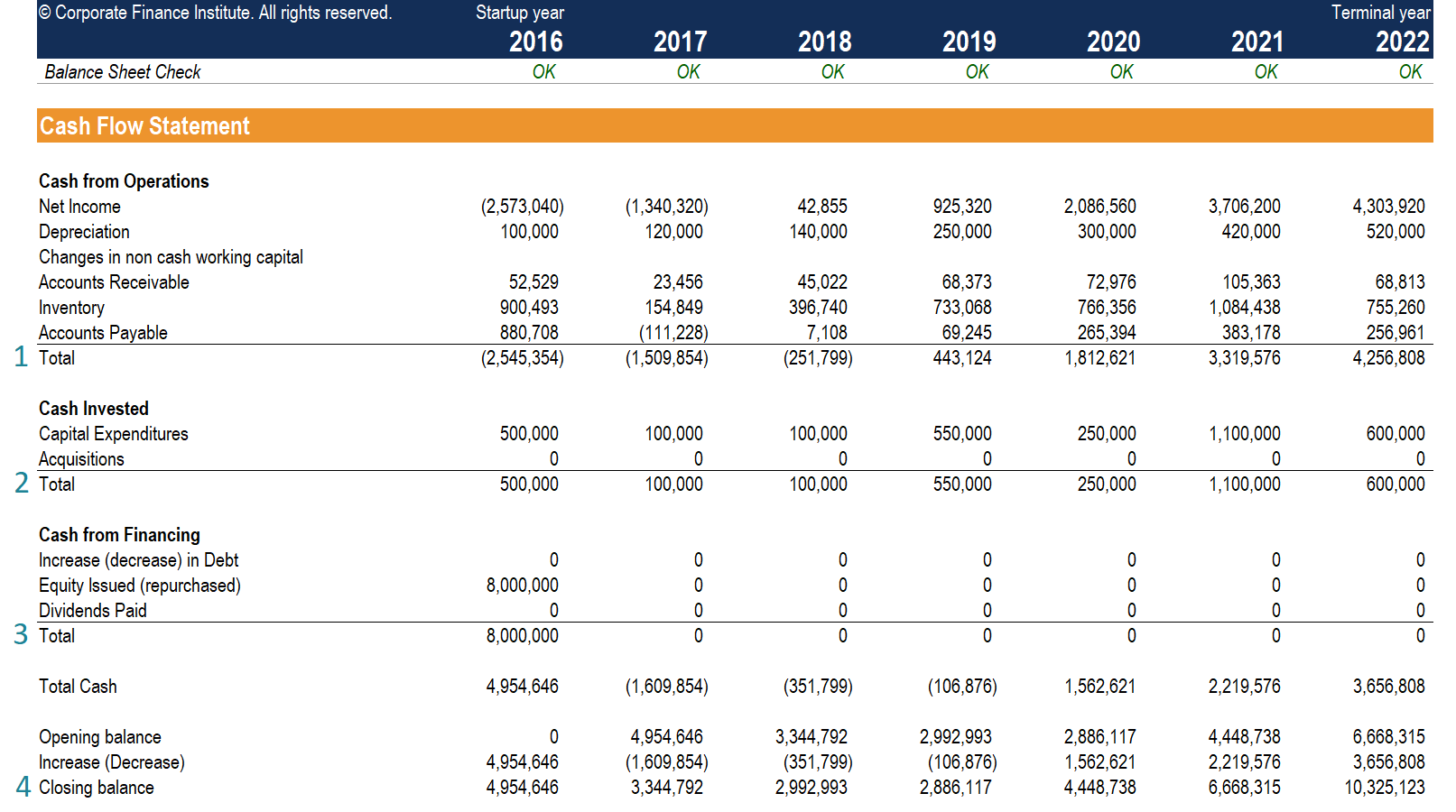

Any change in the balances of each line item of working capital from one period to another will affect a firm. Change in Working Capital means for any Excess Cash Period the lesser of i the amount equal to the Working Capital as of the end of such period minus the Working Capital at the beginning of such period and ii 5 of the revenues of the Issuer and its Restricted Subsidiaries excluding Telecom Personal and its Subsidiaries for the last four consecutive fiscal quarters ending on. When changes in working capital is negative the company is investing heavily in its current assets or else drastically reducing its current liabilities.

Changes in working capital simply shows the net affect on cash flows of this adding and subtracting from current assets and current liabilities. Now changes in net working capital are 3000 10000 Less 7000. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future.

If your working capital ratio is below 1 it may indicate a company is in a risky position. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. Working capital is calculated as.

Therefore working capital will increase. Net Working Capital is the specific concept which considers both current assets and current liability of the concern. If the difference in the net working capital is negative it would mean that current liabilities have increased more such as an increase in bills payables.

Net working capital which is also known as working capital is defined as a companys current assets minus itscurrent liabilities.

How Do Net Income And Operating Cash Flow Differ

How To Calculate Fcfe From Ebitda Overview Formula Example

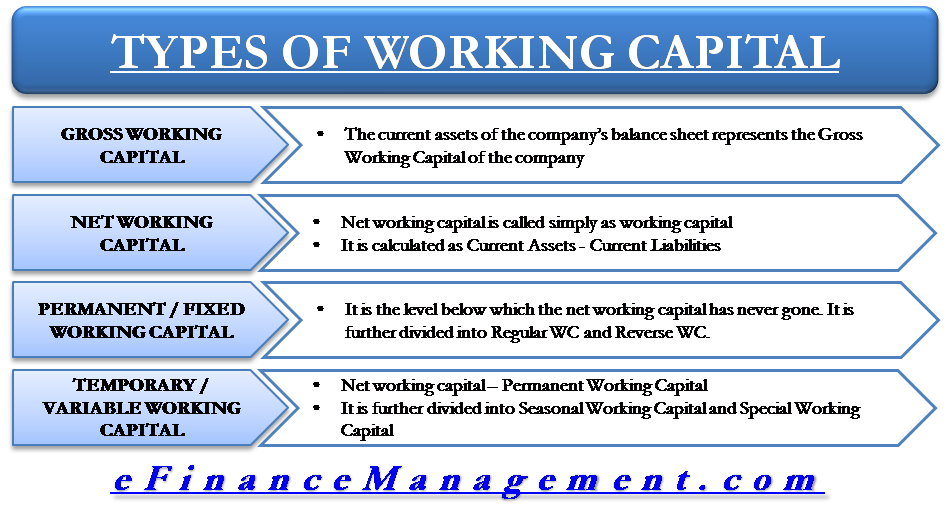

Types Of Working Capital Gross Net Temporary Permanent Efm

Change In Net Working Capital Nwc Formula And Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

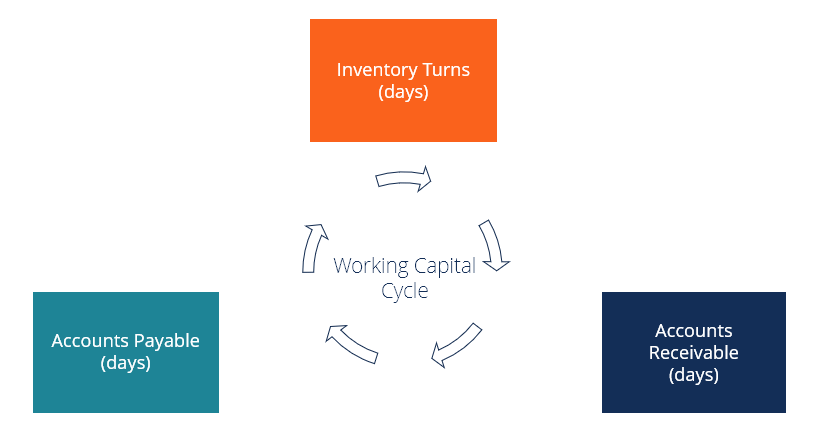

Working Capital Cycle Understanding The Working Capital Cycle

Cash Flow Statement How A Statement Of Cash Flows Works

Working Capital Formula And Calculation Exercise Excel Template

Working Capital Formula And Calculation Exercise Excel Template

Working Capital Cycle Understanding The Working Capital Cycle

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

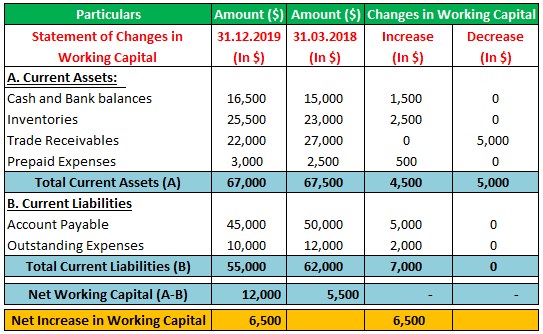

Fund Flow Statement Format How To Prepare Step By Step

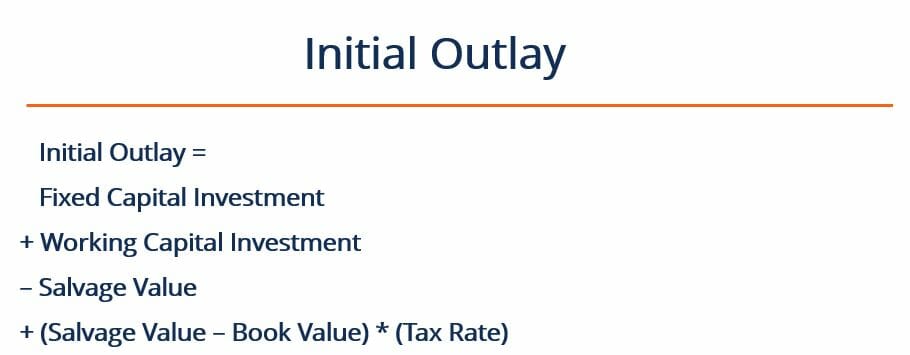

Initial Outlay Definition Explanation And Example Of Initial Outlay

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula And Calculation Exercise Excel Template

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)